Liquidity Aggregation Vs Single-venue Trading: What’s Higher For Psps?

The main drawback of single-venue trading is limited market entry and reduced competitiveness. PSPs are constrained by their provider’s liquidity, pricing, and available buying and selling instruments. If the provider’s spreads aren’t https://www.xcritical.com/ competitive or in the event that they expertise capacity constraints throughout excessive buying and selling quantity intervals, the PSP’s purchasers might endure from suboptimal execution high quality.

Discover How Ai, Modular Architectures, And 24/7 Markets Are Reshaping The Way Ahead For Buying And Selling Technology

Brokers make the most of these platforms to supply shoppers with aggressive pricing, deep liquidity, and quick AML Risk Assessments execution across a number of venues. Asset managers, then again, leverage aggregation solutions to realize best execution, reduce transaction prices, and handle portfolio threat in increasingly complicated and unstable markets. Innovation in this section is centered on delivering user-friendly interfaces, customizable execution algorithms, and seamless integration with portfolio administration and compliance instruments. Aggressive intensity is excessive, with distributors differentiating themselves through area experience, expertise partnerships, and client-centric service fashions. North America dominates the FX Liquidity Aggregation market, accounting for roughly 38% of world market share in 2024.

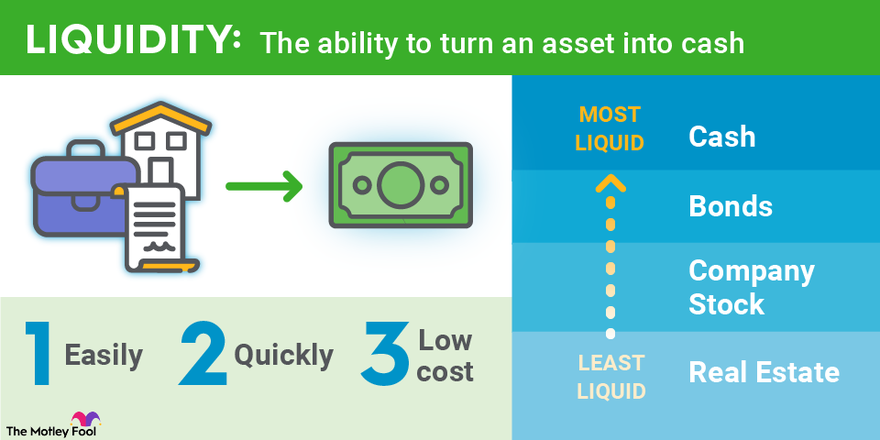

A Definition Of Asset Liquidity

Liquidity aggregation helps ensure optimum conditions for buying property in the FX market by consolidating provides, lowering spreads, and improving commerce execution. Foreign Exchange is a platform where everybody, from a huge company to a newbie trader, can start making a revenue from their funds. This article will discuss liquidity, how it is formed in Foreign Exchange, the distinction between liquidity providers and aggregators, and the latter’s advantages. FX aggregators provide merchants with a depth of market info, exhibiting the available liquidity at different price ranges.

- In the forex market, all of the participants contribute to and are affected by the liquidity state of affairs.

- Thus, implementing liquidity aggregation requires using powerful technology and strong infrastructure, in addition to high-speed connectivity.

- As per our latest market intelligence, the International FX Liquidity Aggregation market dimension was valued at $1.eight billion in 2024, and is forecasted to hit $4.7 billion by 2033, rising at a robust CAGR of eleven.2%.

- Aggregated liquidity approaches end in broader common spreads compared to direct market entry as a outcome of they introduce additional latency when orders get routed through an aggregator.

Advanced Markets is a wholesale provider of prime-of-prime liquidity, credit and know-how options to brokers and asset managers globally. The firm’s products assist direct market access (STP) trading in spot FX, precious metals and vitality, as properly as contracts for variations (CFD) across many monetary and commodity merchandise. It also supplies FX, metals, CFD trading together with credit score options and services, to fund managers, commodity trading advisors and corporate FX market individuals. Via its wholesale shopper base, Superior Markets liquidity finally serves greater than 40,000 institutional and individual purchasers in more than 30 nations globally. Outside buyers embrace Macquarie Americas Corp Inc., a completely owned subsidiary of Macquarie Financial Institution and GFI Group Inc. Via direct connections to main liquidity providers main currency pairs through direct market entry options obtain the narrowest spreads which are zero.1 pips or lower.

Sometimes the order finds the meant liquidity but with so much of the liquidity within the FX market being distributed and redistributed on a last-look foundation there are the issues of contingent liquidity and last-look equity to look at. Earlier Than you realize it, your hit-rate (or reject price if you’re the glass-half-empty guy) no longer represents the yard-stick on which to judge an LP or ECN. What was once an issue that could be solved for an ECN or a dealer with an excel spreadsheet and a pivot table or two, is now a problem that needs an industrialised engineering staff to manage it. Initially often identified as “the handbag Chihuahua”, the liquidity supervisor was introduced to merchants just like the must-have accessory of the period. In Distinction To Tinkerbell Hilton although, the liquidity manager’s bond with their sales colleagues is stronger than ever with no Instagram likes required. If you had been a trader then there have been also brokers who either developed into pals or became the individual you spoke most to every day, but wished to see the least.

Merchants can evaluate liquidity aggregation system provider and choose one of the best available bid and ask costs, leading to tighter spreads and lowered trading prices. In these regions, native banks and brokers are investing in aggregation platforms to compete with international gamers and provide clients with access to deep, multi-venue liquidity. Regulatory initiatives geared toward enhancing market transparency and reducing foreign money volatility are further catalyzing adoption.

Liquidity Soft Solutions: Streamlining Market Access And Buying And Selling Experiences

In the foreign trade market, also referred to as the FX market, liquidity aggregation has turn into increasingly standard among aggressive PSPs. The FX market’s 24-hour nature and the variety of currency pairs obtainable make access to a number of liquidity sources particularly valuable, as trading within the FX market revolves round forex pairs. Completely Different liquidity suppliers could focus on specific regional markets or forex pairs, making aggregation important for complete market coverage. Bloomberg is one other major participant, leveraging its intensive knowledge and analytics capabilities to ship high-performance FX liquidity aggregation solutions. Bloomberg’s platform is broadly adopted by institutional shoppers for its strong execution capabilities, real-time data feeds, and comprehensive compliance instruments. The company’s product strategy emphasizes interoperability, permitting purchasers to integrate Bloomberg’s aggregation expertise with a broad range of trading and danger techniques.

Enhanced Market Depth And Liquidity

The particular requirements you need will differ based mostly on your focused clientele and your small business framework. Study the variations between spread-based pricing constructions and commission-based fashions alongside prime of prime (POP) pricing strategies. Selecting correct LPs permits merchants to maneuver into and out of positions effectively whereas achieving competitive charges. Now you had relationship managers, platform specialists and out of nowhere, the liquidity supervisor was born.